< Back to Main Newsletter Page

To Hesitate or Innovate, $16.5M Series B, ChatGPT & AI-First for Banks, SOC 2, and Product Updates

PortX Fintech News

In this edition of PortX Fintech News, we’re excited to announce PortX’s $16.5M Series B, our perspective on how banks can succeed in both the short and long term during an economic downturn, what’s new for the PortX Platform, and two new partner announcements – Prelim and Abrigo.

Have feedback? Email us at [email protected].

PortX Secures $16.5 Million in Series B Funding With Investors Focused on Community Financial Institutions

We are thrilled to share that we’ve successfully completed our Series B funding round, raising a significant $16.5 million! This milestone reaffirms our dedication and role as innovators in the open banking landscape for community financial institutions.

- Funding underscores shift toward open banking and the demand for seamless core integration and innovation

- Investors represent 200 community financial institutions

- PortX forms Credit Union Service Organization (CUSO)

Our collaboration with FUSE has been a driving force, and as Brendan Wales, Founding Partner at FUSE, shared, “We at FUSE see PortX as a game-changer in the open banking ecosystem. Their vision and technology align perfectly with the industry’s evolving needs. This is our second investment in the company, and it’s not just a vote of confidence in PortX, but a bet on the transformative power of open banking in shaping the future of commerce and financial services. And it’s exciting to partner alongside other visionary investors who are equally committed to innovating and improving financial services for FIs.”

Learn more about the benefits we’re bringing to our customers as a result of this funding by reading the full announcement and this blog from CEO, David Wexler.

A case for innovation over hesitation in an economic slowdown

There’s a notable shift taking place among FIs, with many banks and credit unions choosing to put their projects on hold as a result of the economic slowdown. It’s a natural reaction, especially considering the shocking banking crisis from earlier this year.

According to a recent report from Reuters, U.S. lenders, in light of the current economic scenario, are stockpiling cash as a safety net against a slowing economy, potential deposit outflows, and forthcoming stringent liquidity regulations that may particularly affect mid-sized banks. This defensive stance is a reflection of experiences from earlier in the year, prompting many in the industry to be prepared. “What happened in March was a big wake-up call,” notes David Fanger, Senior Vice President at Moody’s rating agency. By the end of August, U.S. banks’ cash assets had grown to $3.26 trillion, marking an increase of 5.4% from the end of 2022.

However, while hoarding cash might seem like a safe strategy, the lessons from 2008 emphasize the importance of innovation and adaptability.

Adoption of Digital Platforms: After the 2008 crisis, there was a notable shift towards digital banking. By the time the industry recovered, customers had become accustomed to the convenience of digital banking, making it difficult for late adopters to catch up.

Fintech Collaborations: Traditional FIs that embraced collaborations or partnerships with these fintechs, or even those that built in-house innovative solutions, gained a competitive advantage in delivering better customer experiences and more efficient operations.

Diversification of Services: Some of the best-performing banks during and after the 2008 crisis were those that diversified their services, often enabled by technological innovations.

Resilience to Future Shocks: The FIs that innovated during the 2008 crisis were also better prepared for future shocks, such as the COVID-19 pandemic. Their prior investments in digital platforms and infrastructure allowed them to quickly adapt to the new norm of remote banking and service delivery.

FIs that merely stockpile resources without strategically investing in technology and innovation risk being left behind when the economy turns around. It’s a delicate balance of preparing for the immediate future while ensuring long-term growth and competitiveness. The current economic slowdown is not just a challenge but an opportunity for FIs to introspect, innovate, and come out stronger.

If you would like to learn more about how we are helping our customers navigate this balance, start a conversation today.

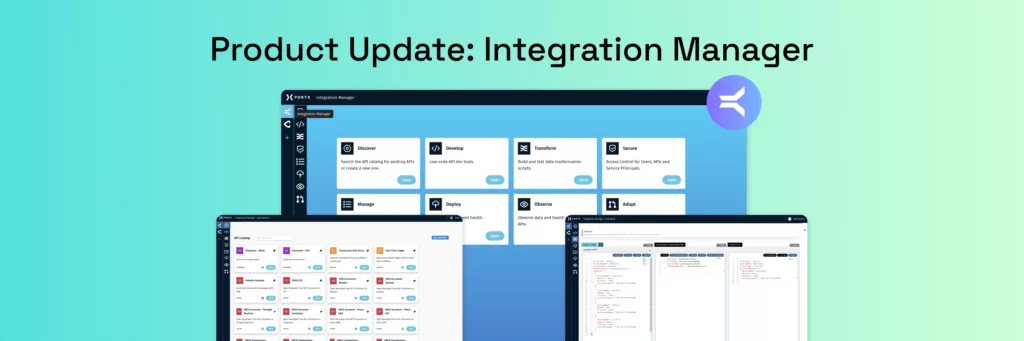

Product update: Integration Manager’s latest enhancements

With the release of Integration Manager 2.0 and subsequent enhancements, we’ve focused on making your API development and management journey more efficient and user-friendly. Discover the new features and get a glimpse of what’s around the corner.

Newest updates

Unified Management Console: Centralizes API lifecycle management for improved efficiency.

- Payment Manager Integration: Seamlessly included in the management console for streamlined payment handling.

- Direct Third-Party Vendor Integration: A singular, adaptable access point for account management, enabling the direct incorporation of third-party partners into the console.

Unified Observability Portal: Pinpoints system failures and empowers you to inform vendors of specific issues while also providing insights for proactive resource management and enabling real-time alerts.

No-Code API Development: This versatile, no-code tool simplifies complex integration tasks and is easy to use for both developers and IT administrators, empowering your whole team.

Identity and Access Management: Enhances operational efficiency and security by providing precise, granular control over vendor access and data management.

API Catalog: A visual tool that simplifies the discovery and reuse of APIs to avoid work duplication.

Data Transformation Playground: Simplified data mapping interface with DataSonnet built right in.

Revamped API Docs: A standardized, well-documented portal using PortX templates, allowing you to securely share APIs and access keys with partners.

What’s on our roadmap?

We’re currently developing several exciting enhancements to elevate your user experience further. You can look forward to expanded observability dashboards for deeper insights, smoother integration between development and management workflows with visual tools such as advanced data mappers, and an enriched API catalog offering a more comprehensive range.

Read our blog for a detailed update about the new features in the PortX platform and a sneak peek at what’s next.

Announcements: PortX secures SOC 2 Type 2 and new partners Prelim & Abrigo

SOC 2 Type 2

PortX has achieved the SOC 2 Type 2 certification, reflecting our commitment to rigorous security and operational standards. This certification not only underscores the robust security infrastructure we’ve designed for our products and internal procedures but also aids our customers in meeting compliance standards and streamlining their auditing processes.

Read our blog to learn about the details of SOC 2 Type 2 and its benefits to our customers.

Prelim

Prelim, a premier Silicon Valley fintech, specializes in digital onboarding for various deposit accounts and offers a no-code platform built by banking experts to streamline and enhance the customer and employee journey through automation. Their solutions, which encompass everything from identity verification to core services issuance, significantly improve the banking experience.

“Joining the PortX fintech ecosystem and integrating with its Open Banking API will allow us to continue to provide best-in-class access to providers within the platform,” said Heang Chan, the CEO of Prelim. “Prelim supports over 100 financial products; thus, working with PortX enables us to offer our customers an even more seamless digital banking experience that is integrated with their cores.”

Learn more about our partnership with Prelim by reading the full announcement.

Abrigo

Abrigo, a top provider of solutions in credit risk, lending, and asset/liability management, empowers financial institutions with an expansive platform that enhances growth, efficiency, and customer experience. Boasting a network of over 2,400 financial institutions, they deliver unparalleled advisory expertise, innovative technology, and award-winning client service.

“By leveraging this software, financial institutions can provide their customers with the funds they need faster while ensuring they have controls in place for proper data management,” said Nolan Gesher, Senior Vice President of Sales Enablement at Abrigo. “We are very pleased to partner with PortX to advance our mission to help communities thrive.”

Learn more about our partnership with Abrigo by reading the full announcement.

What’s New in the Blog?

Watch for our latest blog posts, where we share our thoughts on industry trends, insights, and best practices. Here are a few of our latest posts that you may be interested in:

Automated Clearing House (ACH) transactions, managed by FIs through core vendors or manual entry, face challenges like outdated interfaces, lack of control, and potential for errors, prompting a need for modern, flexible solutions like PortX’s automated ACH system, which offers increased efficiency, control, and integration.

AI and ChatGPT Accelerate Banking Integration and Fintech Deployment

Artificial Intelligence, particularly Large Language Models, offers financial institutions an AI-first integration approach for faster product launches, operational efficiencies, and dynamic error correction, with PortX providing expertise in AI agent training, governance, and API development to facilitate seamless integration.

ChatGPT Use Cases for Banking: An AI-First Approach to Financial Services

This blog explores how financial institutions are leveraging AI and advanced language models like ChatGPT to drive transformation, detailing its workings, use cases, and PortX’s pioneering efforts in integrating it into the financial sector.

Help share PortX Fintech News

Don’t keep us a secret! PortX is removing the barriers that impede innovation in financial services. We build infrastructure that delivers open access to data, simplified application connectivity, and accelerated adoption of new technologies and networks.

- Share this email with friends.

- Sign up for the Newsletter here.

- Follow us on LinkedIn

- Please send feedback to [email protected]