FEATURED POST

Blog

Latest Posts >

Stay in the loop!

Subscribe to our newsletter:

API Strategy for Open Banking Regulations in the U.S. – Why Financial Institutions Should Prepare for FDX and CFPB 1033 Today

TL;DR: The Consumer Protection Financial Bureau (CFPB) expects to implement Section 1033 of the Dodd-Frank Act in the fall of 2024. What does this mean for community banks and credit unions and the future of open banking in the U.S.? Open banking regulations began globally, with Europe’s PSD2 in 2016 and a handful of countries […]

Read More >The Resilient FI: How Prepared is Your Bank or Credit Union for the Next Big Crisis or Rapid Growth?

An uncalculated or delayed response to market demands can have disastrous effects on a financial institution’s business operations. The same can be true if your financial institution isn’t prepared to react to rapid growth. How do you future-proof your organization, and what does that look like in financial services? This blog serves as an introduction […]

Read More >Automating ACH: Banks and Credit Unions Eliminate Rejected Files and Slash Error Handling by Half

The Automated Clearing House (ACH) network, established by Nacha and operated by The Federal Reserve and The Clearing House Electronic Payments Network, serves as a crucial infrastructure for managing electronic payments and collections in the U.S. Despite its reliability for handling transactions such as bill payments and direct deposits, the traditional ACH system is confronting […]

Read More >Payment Manager Automates Wire Transfer Process for Regional Bank – Saving Time and Reducing Errors

This use case examines how a regional bank utilized PortX’s Payment Manager to revolutionize its wire transfer process, transitioning from a labor-intensive system fraught with redundancies and errors to a streamlined, automated solution. The Challenge The bank faced significant challenges in its wire transfer process. Tedious, manual steps involving multiple data re-entry and verification procedures […]

Read More >Banking Experts Reveal: Top Integration Mistakes for Banks and Credit Unions to Avoid with Fintech Partners

I interviewed two of our sales team leaders, Nick Paoloni and Alex Paoloni, cousins who have worked in the fintech integration space for over 20+ years. My goal was to understand better how banks, credit unions, and fintechs currently think about integration and how they can avoid the cringe-worthy, innovation-stifling, point-to-point architecture that is prevalent […]

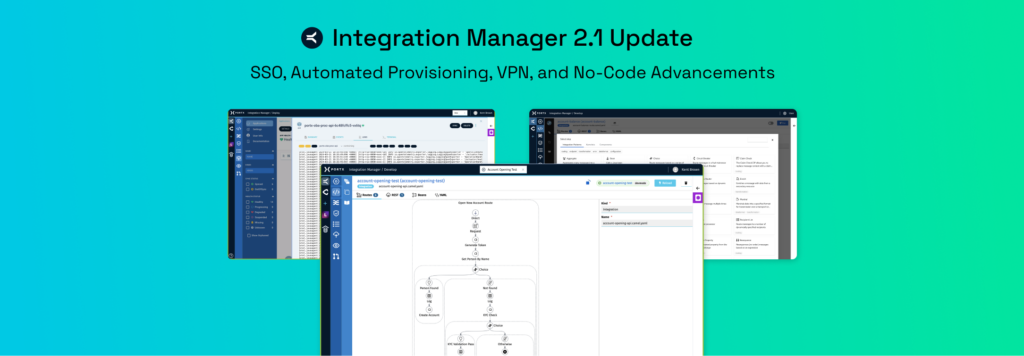

Read More >Integration Manager 2.1 Update – SSO, Automated Provisioning, VPN, and No-Code Advancements

Integration Manager continues to evolve as a leading solution for financial institutions (FIs) aiming to streamline their digital core banking integration. Building on the successful launch of version 2.0, we’ve released Integration Manager 2.1, which brings enhancements designed to simplify API development and management for banks and credit unions, enabling them to rapidly adapt to […]

Read More >Embedded Finance in Enterprise Resource Planning (ERP) Systems – A Competitive Edge for FIs

We interact with innovative financial institutions (FIs) on a daily basis, examining and assessing the embedded finance model. At PortX, our experience in integrating enterprise resource planning (ERP) tools has led to several discussions with our customers about creating new business lines that allow FI services to be directly embedded into a corporate customer’s ERP […]

Read More >4 Hot Topics in Banking Integration for Financial Institutions

Daily conversations with leaders from banks and credit unions have resulted in unique insights into the evolving landscape of banking integration. Every discussion reveals a fascinating, rapidly changing world where technology and customer expectations reshape how financial institutions (FIs) operate. In this blog, I’m excited to share a few hot topics dominating our conversations this […]

Read More >5 Must-Read Blogs of 2023: Insights for Financial Institution Leaders

I’m constantly inspired by our team members’ innovative thinking and insights. Reflecting on 2023, I want to highlight five thought leadership blogs from our employees (and one from me) that every financial institution leader should read. Each blog presents crucial advancements and ideas reshaping how our financial institution (FI) customers operate and innovate. As this […]

Read More >