No posts found for this category

Backbase

The Challenge

The bank faced significant challenges in its wire transfer process. Tedious, manual steps involving multiple data re-entry and verification procedures slowed operations and increased the risk of errors and inefficiencies. For every wire transfer, the bank manually entered the details and emailed them internally, requiring another employee to re-enter the same information into a different system. The process necessitated another manual check before finally sending the information to the Federal Reserve. This convoluted process consumed valuable time and resources, detracting from the bank's ability to serve its customers efficiently.The Solution

Recognizing these challenges, the bank partnered with PortX to implement Payment Manager - a tool that allows financial institutions (FIs) to manage all payment channels on a single screen.Key Components of Payment Manager:

Wire Initiation

The customer primarily initiated wires in one of two ways:- Business Online Banking (BOB): Business customers could initiate wire transfers directly within the BOB interface. Payment Manager automatically processes these requests, conducts necessary checks, and seamlessly forwards the request for final processing.

- Branch Initiation: Customers visiting bank branches could have their wire requests processed directly at the teller's window. The teller enters transaction details into the Wire Initiation Screen, and the system handles the rest, significantly reducing processing time and human error.

Wire initiation screen - Staff utilize this screen to initiate a new wire transaction.[/caption]

Wire initiation screen - Staff utilize this screen to initiate a new wire transaction.[/caption]Supervisor Workflow

This component acts as the core of the automation, orchestrating the wire's lifecycle from initiation to completion. It automatically performs checks for limits and compliance (such as OFAC), requires minimal manual intervention, and ensures all operations adhere to regulatory and internal standards. [caption id="attachment_7068" align="alignnone" width="1919"] Wire Task Activity Dashboard - Staff can manage wire exemptions, approve or reject wires, and repair and make OFAC decisions.[/caption] [caption id="attachment_7067" align="alignnone" width="1919"]

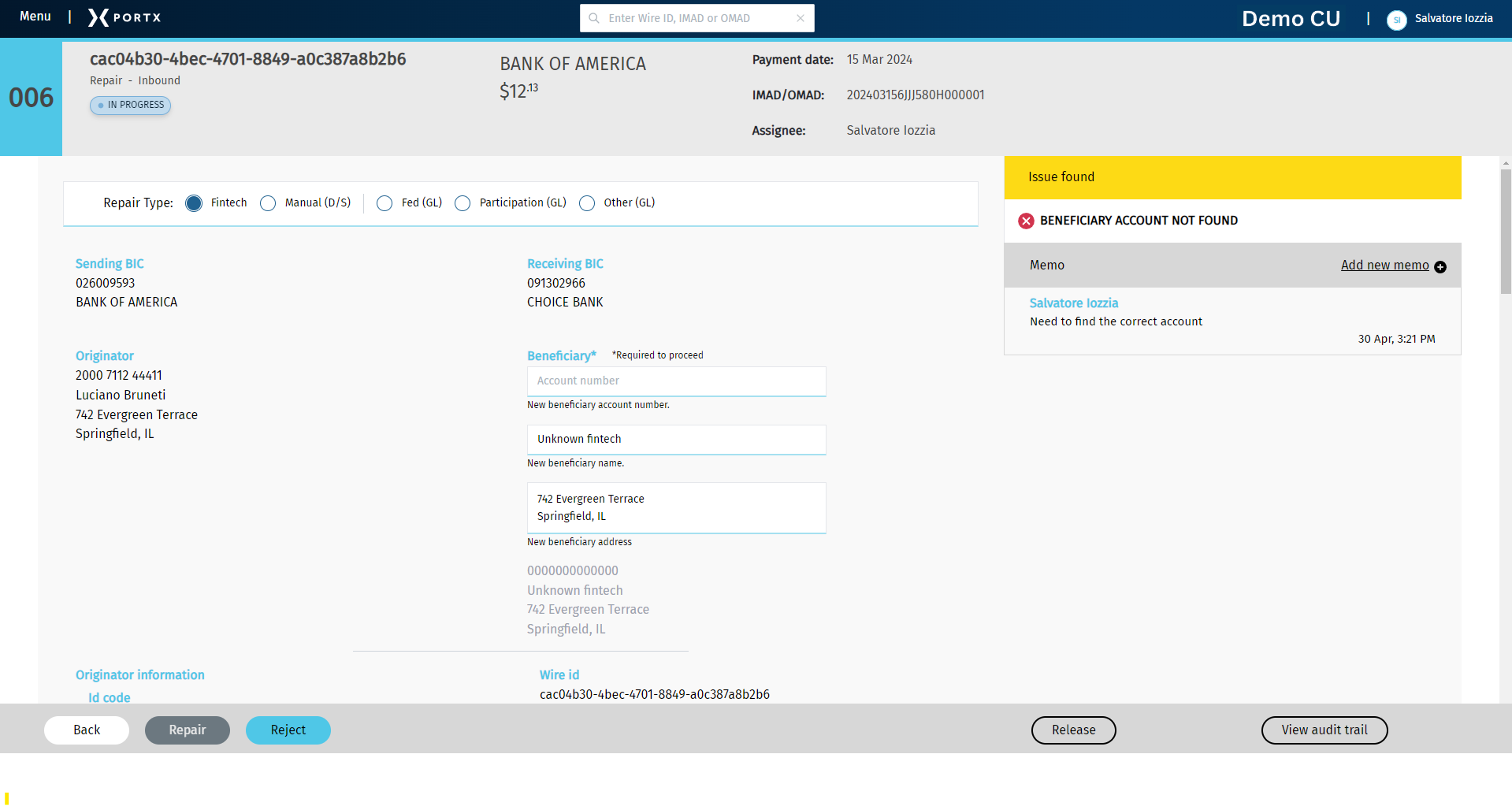

Wire Task Activity Dashboard - Staff can manage wire exemptions, approve or reject wires, and repair and make OFAC decisions.[/caption] [caption id="attachment_7067" align="alignnone" width="1919"] Wire Repair screen - Staff can select or enter beneficiary or receiving bank information. Built-in templates make some repairs a one-click task.[/caption]

Wire Repair screen - Staff can select or enter beneficiary or receiving bank information. Built-in templates make some repairs a one-click task.[/caption]Fedwire-as-a-Service

Integrated directly with the Federal Reserve, this component handles the actual transmission of wire requests, ensuring secure and timely processing. [caption id="attachment_7069" align="alignnone" width="1919"] Service Message Manager - Staff can easily read, reply, and compose service messages.[/caption]

Service Message Manager - Staff can easily read, reply, and compose service messages.[/caption]The Future and Why it Matters

The solution modernizes a critical banking function and sets a standard for operational excellence that benefits both the bank and its customers. By automating wire transfers, the bank ensures faster transaction times, enhanced security, and improved customer satisfaction. For the banking sector at large, especially for community banks and credit unions, this level of innovation and automation demonstrates the potential to remain competitive in a market increasingly dominated by technological advancements. Our customers have projected annual cost savings ranging from $150k to $280k due to automating payments. This regional bank transformed its approach to managing wire transfers by adopting PortX's Payment Manager. Contact our team today to schedule a demo or if you’d like to learn more about Payment Manager and automating your FI’s wire transfer operations.Quick Info

Latest Version

Blogs & Case Studies

View All July 18, 2024

Integration Platform as a Service: One Tool to Cut Costs, Eliminate Dependencies, and Scale Fintech Connections

Financial institutions that leverage an Integration Platform as a Service (iPaaS) can adapt to technological changes efficiently, meet evolving consumer demands quickly, and navigate complex regulatory requirements easier than others in the industry while cutting costs and overhead. This blog delves deeper into what iPaaS means for financial institutions (FIs), why it is an essential […] Read More >

June 27, 2024

API Strategy for Open Banking Regulations in the U.S. – Why Financial Institutions Should Prepare for FDX and CFPB 1033 Today

TL;DR: The Consumer Protection Financial Bureau (CFPB) expects to implement Section 1033 of the Dodd-Frank Act in the fall of 2024. What does this mean for community banks and credit unions and the future of open banking in the U.S.? Open banking regulations began globally, with Europe’s PSD2 in 2016 and a handful of countries […] Read More >

May 28, 2024

The Resilient FI: How Prepared is Your Bank or Credit Union for the Next Big Crisis or Rapid Growth?

An uncalculated or delayed response to market demands can have disastrous effects on a financial institution’s business operations. The same can be true if your financial institution isn’t prepared to react to rapid growth. How do you future-proof your organization, and what does that look like in financial services? This blog serves as an introduction […] Read More >

Interested in our connectors? Get in touch.